We’ve all overheard people talking about getting into the “investment game.” Outside of movie and television, however, you’d be hard-pressed to find many professionals describing investing (or reaching your financial goals) as that common cliché: a game. Especially during times of uncertainty.

What these professionals would agree with is the often-cited importance of learning the rules – a few basic principles and strategies for success – prior to diving in.

That’s because each investment basic you work to understand and apply leads to another connecting and useful thread. For instance, if you get to know how market cycles work, you can avoid making emotional decisions during downtrends (e.g., selling an investment earlier than planned, out of fear). And, if you avoid making emotional investing decisions, you won’t be tempted to time the market, only to jump back in when you think it’s safe. On and on.

Underlying these investing basics is the simplest principle of all: having clearly defined, goal-oriented priorities and a plan for sticking to them.

Your future is worth the effort

Your goals become the foundation of your financial roadmap. While they may shift as life moves forward, taking the time to define them at the beginning of your journey (and revisiting them along the way) allows you to stay focused and achieve success. With a solid plan in place, you’ll feel more confident in all of your investing-related decisions.

Keep these tips in mind when identifying and reviewing your goals:

Complete the goal-defining process. Picking a few goals – retirement, a dream vacation, or anything else – seems simple, but it gets a lot harder when listing the specifics. Consider factors like these: How much time do you have to reach your goals? Are you on track to get there? If not, how “off path” are you?

Trust that you’re making the right decisions. Your goals, and the investments you select as a result, are based on your personal situation and your view of the future. That doesn’t mean you have to fulfill the journey alone. Working with a financial representative* can help you work through your financial objectives, with increased accuracy, ease and confidence around your financial future. That can also help you navigate life changes, as they occur.

Achieve your financial goals easier with a clear roadmap

Remember, there are no right or wrong answers when defining your goals. Nor is one style of investing – more conservative or more aggressive – better than another. The trick is to choose a path that works, and stay the course.

From there, reaching your goals is paramount, and your vision becomes the bar against which your every investing decision is measured. At any time, just ask yourself: Will doing “this” help me reach my goal or detract from it?

A roadmap can also prove helpful in times of market uncertainty, when it’s tempting to make rash investing decisions. Having a clear vision – including specific milestones – can help you focus on the end goal.

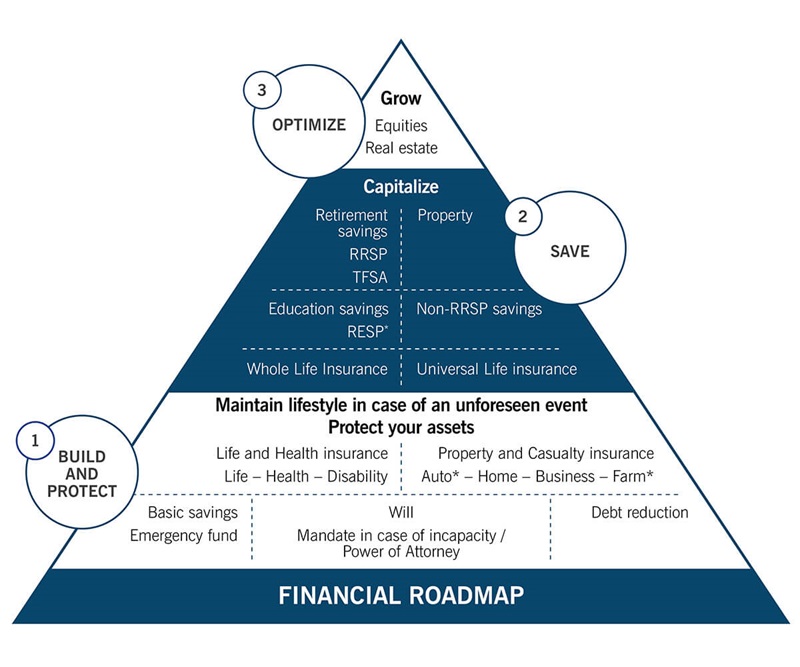

The following diagram outlines the many building blocks to financial success:

Following these building blocks will make it easier to plot (or revise) your own financial roadmap. Then, keep it handy for regular review – on your own or with your financial representative – to ensure that you’re staying true to your chosen path.

We’re here when you need us

Our financial representatives can help you start investing with more purpose. Talk to us today.

For more information, resources and financial-market news – including helpful insights and analysis – visit Market View.

We can help you ask the right questions.Find a Financial Representative

Co-operators financial representative near you.