There’s no denying it. Investing is an emotional experience. After all, it’s your money and your financial future we’re talking about. But, keeping your emotions in check – and staying focused on a plan that’s geared toward your goals and risk tolerance – can be essential to your long-term investing success.

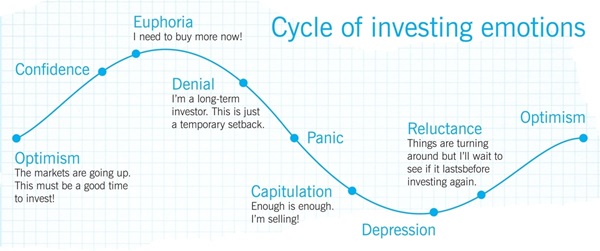

Surely, you can relate to this rollercoaster-like graphic. How many of these feelings have you lived through as an investor?

Source: Co-operators Life Insurance Company

Going through this cycle of emotions is only natural. The challenge is how you react to the peaks and valleys, especially when the market dips – a lot. Consider the following:

When markets are up, and life is good, you might ask yourself, Should I invest more? So, it’s also helpful to think about the reverse scenario. During the “capitulation” stage, when markets are down, you might ask yourself, Should I cut my losses and sell? It’s human nature to want to take action, but if you sell, you’ll be faced with a much different reality when markets eventually recover – and when “optimism,” then “euphoria,” reappears. In short, by removing yourself from the market, you risk losing out on the market recovery and positive gains.

The true test isn’t finding the best time to buy or sell. It’s finding a way to look past the media headlines, push aside your instincts to act suddenly or emotionally, and stay true to your reasons for investing in the first place. Then, you can let the natural market cycle take care of the rest.

Here are some tips to help you stay the course.

How to avoid emotional investing decisions

Experiencing success and reaching your goals isn’t just about financial facts and figures. It requires a solid understanding of your instincts and behaviour. Keep these basics in mind, when you’re feeling anxious about your investments.

Stay focused on your goals. If you’re second-guessing your plan, it can be helpful to revisit your goals. Ask yourself: Have my goals changed? Is my financial situation different than when I started? If the only thing that’s changed is the market, try to look past the short-term loss and focus on the long-term prospects. History continues to show us that markets rebound and trend upwards.

Review your time horizon and your risk tolerance. No one can predict when the markets will rise or fall, or by how much. This makes timing the market next to impossible. That’s why your investment strategy, from the outset, is based on your goals, your risk tolerance and your time horizon – not the market’s! For example, if your time horizon is long, you’re likely comfortable taking on greater risk and you may experience greater impacts (both positive and negative) from market fluctuations. On the other hand, if your goals have a shorter time horizon, you may choose to take on a lower level of risk, so your investments are less impacted by market fluctuations. Whatever the case, it’s important to keep market fluctuations in perspective.

Be informed (not influenced) by the news. When the market falls, the surge of headlines can be a great source of stress and anxiety. Remember, media and news reports can be informative and beneficial, but they shouldn’t be a driving force in your decision-making. Market declines always need to be put into perspective, with your goals at the centre. And speaking with a financial professional can add far greater value than merely following the headlines.

We’re here for you

Our financial representatives* can help you create an investment plan that’s geared toward your personal goals, risk tolerance and time horizon.

For more information, resources and financial-market news – including helpful insights and analysis – visit Market View.

* **In the province of Quebec, the authorized representatives are Financial Security Advisors who have been duly certified by the Autorité des marchés financiers. Segregated Funds and annuities are administered by Co-operators Life Insurance Company. This article is provided as a general source of information for a specific point in time and should not be considered solicitation to buy or sell any investment. Nothing contained in this article constitutes investment, legal, tax or other advice. Co-operators Life Insurance Company is committed to protecting the privacy, confidentiality, accuracy and security of the personal information that we collect, use, retain and disclose in the course of conducting our business. Please refer to our privacy policy for more information. The Co-operators® is a registered trademark of The Co-operators Group Limited..

We can show you what you can and can’t control.Find a financial representative

Co-operators financial representative near you.