Quarterly Portfolio Fund update

What happened in financial markets during Q3 2025?

Stock and bond markets*

| INDEX | CLOSE | Q3 | YTD |

|---|---|---|---|

| S&P/TSX Composite | 30,022.81 | 11.79% | 21.41% |

| Dow Jones Industrial Average | 46,397.89 | 5.22% | 9.06% |

| S&P 500 Index | 6,688.46 | 7.79% | 13.72% |

| NASDAQ Composite | 22,660.01 | 11.24% | 17.34% |

| 10-year Canadian Bond Yield | 3.17% | -0.11% | -0.06% |

| 10-year U.S. Treasury Yield | 4.16% | -0.08% | -0.42% |

| WTI Crude Oil (US$/barrel) | US$62.37 | -4.21% | -13.04 |

| Canadian Dollar | $0.72 | -1.98% | 3.35% |

| Bank of Canada Prime Rate 4.70% |

*Performance ending September 30, 2025. Sources: Morningstar Direct, Bank of Canada, U.S. Department of the Treasury and CME Group

Read Investment Update weekly for the latest information on the financial markets, insights around current headlines, special reports, and more.

How Portfolio Funds performed during Q3 2025

Portfolio Funds provided strong returns in the third quarter, with growth portfolios outpacing income.

Note: Rates of return for each portfolio are provided below on an after-fees (net) basis. Given that fees are only applied at the portfolio level, all references to underlying fund performance are before fees (gross).

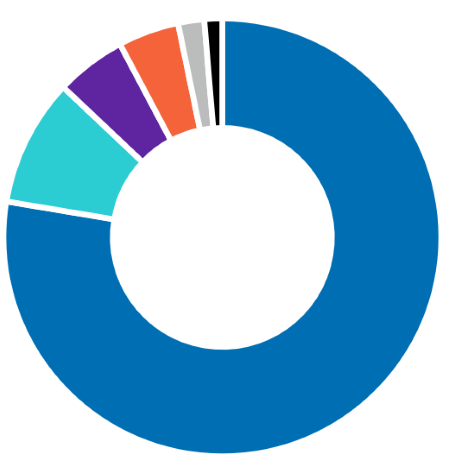

Co-operators Income Portfolio: low risk

Designed to achieve interest income, and the preservation and moderate growth of capital, with low levels of volatility.

The Co-operators Fidelity Canadian Bond Fund and the Co-operators Canadian Fixed Income Fund outperformed their respective benchmarks by over 0.15%, supported by the Bank of Canada’s accommodative monetary policy position. The Co-operators Canadian Equity Fund led the fund’s equity holdings, as Canadian equity markets rallied throughout the quarter.

- Canadian Fixed Income 78.08%

- Canadian Equity 9.85%

- U.S. Equity 4.97%

- International Equity 4.92%

- Foreign Fixed Income 1.18%

- Cash & Other Net Assets 1.00%

| Guarantee level | Q3 | 1 year | 3 year | 5 year | 10 year | Since inception Dec. 22, 2014 |

|---|---|---|---|---|---|---|

| 75-75 | 2.16% | 4.44% | 5.81% | 0.66% | 2.00% | 1.97% |

| 75-100 | 2.13% | 4.33% | 5.70% | 0.56% | 1.89% | 1.86% |

| 100-100 | 2.03% | 3.93% | 5.30% | 0.17% | 1.50% | 1.47% |

| Top 10 holdings | |

|---|---|

| Co-operators Canadian Fixed Income Fund | 29.97% |

| Co-operators BlackRock Canada Universe Bond Index Fund | 29.97% |

| Co-operators Fidelity Canadian Bond Fund | 19.97% |

| Co-operators Mawer International Equity Fund | 5.04% |

| Co-operators Canadian Equity Fund | 5.03% |

| Co-operators Mawer Canadian Equity Fund | 5.00% |

| Co-operators BlackRock U.S. Equity Index Fund | 2.52% |

| Co-operators U.S. Equity Fund | 2.50% |

| The top 10 investments make up 100.00% of the fund. Total number of investments: 8 |

|

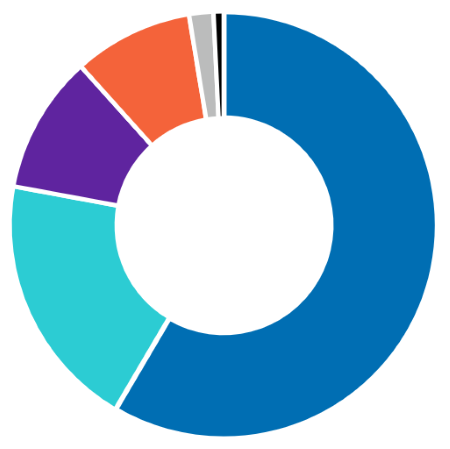

Co-operators Balanced Income Portfolio: low to moderate risk

Designed to achieve both interest income and capital growth, with relatively low levels of volatility.

The Co-operators Canadian Fixed Income Fund led the way in Q3, adding four basis points (bps) of active return after beating its benchmark by 17 bps. Canadian bonds provided positive returns, supported by the Bank of Canada’s September rate cut. The portfolio’s underexposure to gold-related stocks weighed negatively on the portfolio’s performance in the third quarter.

- Canadian Fixed Income 58.65%

- Canadian Equity 19.66%

- U.S. Equity 9.93%

- International Equity 9.82%

- Cash & Other Net Assets 1.22%

- Foreign Fixed Income 0.72%

| Guarantee level | Q3 | 1 year | 3 year | 5 year | 10 year | Since inception Dec. 22, 2014 |

|---|---|---|---|---|---|---|

| 75-75 | 3.20% | 7.60% | 8.60% | 3.17% | 3.68% | 3.55% |

| 75-100 | 3.15% | 7.43% | 8.43% | 3.01% | 3.51% | 3.39% |

| 100-100 | 3.00% | 6.79% | 7.78% | 2.39% | 2.90% | 2.78% |

| Top 10 holdings | |

|---|---|

| Co-operators Canadian Fixed Income Fund | 24.95% |

| Co-operators BlackRock Canada Universe Bond Index Fund | 24.95% |

| Co-operators Mawer International Equity Fund | 10.06% |

| Co-operators Canadian Equity Fund | 10.05% |

| Co-operators Mawer Canadian Equity Fund | 9.98% |

| Co-operators Fidelity Canadian Bond Fund | 9.98% |

| Co-operators BlackRock U.S. Equity Index Fund | 5.03% |

| Co-operators U.S. Equity Fund | 5.00% |

| The top 10 investments make up 100.00% of the fund. Total number of investments: 8 |

|

Co-operators Balanced Growth Portfolio: low to moderate risk

Designed to achieve both interest income and capital growth, with relatively modest levels of volatility.

The Co-operators Canadian Equity Fund had a strong quarter on an absolute return basis, posting a 10.26% gain. Despite underperforming its benchmark by 2.24%, the fund – which makes up 15% of the overall portfolio - added the largest absolute return. Allocations toward international equities weighed negatively on the portfolio’s return in Q3.

- Canadian Fixed Income 39.24%

- Canadian Equity 33.65%

- International Equity 14.93%

- U.S. Equity 10.45%

- Cash & Other Net Assets 1.46%

- Foreign Fixed Income 0.27%

| Guarantee level | Q3 | 1 year | 3 year | 5 year | 10 year | Since inception Dec. 22, 2014 |

|---|---|---|---|---|---|---|

| 75-75 | 4.34% | 11.40% | 11.44% | 5.89% | 5.33% | 5.09% |

| 75-100 | 4.30% | 11.21% | 11.26% | 5.72% | 5.16% | 4.91% |

| 100-100 | 4.15% | 10.56% | 10.60% | 5.09% | 4.54% | 4.30% |

| Top 10 holdings | |

|---|---|

| Co-operators Canadian Fixed Income Fund | 19.93% |

| Co-operators BlackRock Canada Universe Bond Index Fund | 19.93% |

| Co-operators Mawer International Equity Fund | 15.07% |

| Co-operators Canadian Equity Fund | 15.06% |

| Co-operators Fidelity True North® Fund | 10.03% |

| Co-operators Mawer Canadian Equity Fund | 9.97% |

| Co-operators BlackRock U.S. Equity Index Fund | 5.02% |

| Co-operators U.S. Equity Fund | 4.99% |

| The top 10 investments make up 100.00% of the fund. Total number of investments: 8 |

|

Co-operators Growth Portfolio: low to moderate risk

Designed to achieve long-term capital growth, with some interest income.

The Co-operators Fidelity Global Fund outperformed its benchmark by 1.98% and added 20 bps of active return. The outperformance was primarily driven by investments in the consumer discretionary sector. The portfolio’s underexposure to gold-related stocks weighed negatively on performance, as gold producers enjoyed a strong rally amid geopolitical uncertainty and increased buying from central banks.

- Canadian Equity 43.99%

- International Equity 21.40%

- Canadian Fixed Income 19.59%

- U.S. Equity 13.23%

- Cash & Other Net Assets 1.65%

- Foreign Fixed Income 0.14%

| Guarantee level | Q3 | 1 year | 3 year | 5 year | 10 year | Since inception Dec. 22, 2014 |

|---|---|---|---|---|---|---|

| 75-75 | 5.91% | 15.34% | 14.50% | 8.68% | 7.09% | 6.75% |

| 75-100 | 5.87% | 15.15% | 14.31% | 8.50% | 6.92% | 6.58% |

| 100-100 | 5.71% | 14.47% | 13.64% | 7.86% | 6.28% | 5.95% |

| Top 10 holdings | |

|---|---|

| Co-operators Canadian Equity Fund | 20.04% |

| Co-operators Mawer International Equity Fund | 15.05% |

| Co-operators Mawer Canadian Equity Fund | 14.93% |

| Co-operators Fidelity Global Fund | 10.08% |

| Co-operators Fidelity True North® Fund | 10.02% |

| Co-operators Canadian Fixed Income Fund | 9.95% |

| Co-operators BlackRock Canada Universe Bond Index Fund | 9.94% |

| Co-operators BlackRock U.S. Equity Index Fund | 5.01% |

| Co-operators U.S. Equity Fund | 4.98% |

| The top 10 investments make up 100.00% of the fund. Total number of investments: 9 |

|

Co-operators Maximum Growth Portfolio: moderate risk

Designed to achieve maximum capital growth over the long term.

The Co-operators Fidelity Global Fund beat its benchmark and added 20 bps to the portfolio’s active return. The portfolio’s allocation to the Co-operators Fidelity True North Fund underperformed its benchmark but added 1.23% to the portfolio’s return on an absolute basis.

- Canadian Equity 58.39%

- International Equity 21.47%

- U.S. Equity 18.43%

- Cash & Other Net Assets 1.69%

- Canadian Fixed Income 0.02%

| Guarantee level | Q3 | 1 year | 3 year | 5 year | 10 year | Since inception Dec. 22, 2014 |

|---|---|---|---|---|---|---|

| 75-75 | 7.70% | 19.67% | 17.69% | 11.86% | 9.00% | 8.44% |

| 75-100 | 7.64% | 19.41% | 17.43% | 11.61% | 8.76% | 8.21% |

| 100-100 | 7.44% | 18.51% | 16.55% | 10.78% | 7.95% | 7.40% |

| Top 10 holdings | |

|---|---|

| Co-operators Canadian Equity Fund | 20.02% |

| Co-operators Mawer International Equity Fund | 15.03% |

| Co-operators Fidelity True North® Fund | 15.01% |

| Co-operators Mawer Canadian Equity Fund | 14.91% |

| Co-operators Fidelity Global Fund | 10.06% |

| Co-operators BlackRock Canadian Equity Index Fund | 10.00% |

| Co-operators BlackRock U.S. Equity Fund Fund | 7.51% |

| Co-operators U.S. Equity Fund | 7.46% |

| The top 10 investments make up 100.00% of the fund. Total number of investments: 8 |

|

Key take-aways

Canadian equity markets had a strong quarter, supported by the materials sector as gold prices surged. The financials sector, which accounts for about one-third of Canada’s benchmark S&P/TSX Composite, also performed well. U.S. equity markets continued to climb as the AI boom showed no signs of slowing down. International equity markets stabilized in Q3 as the global trade outlook improved. Canadian bonds posted positive returns, supported by Bank of Canada rate cuts, falling short-term yields, and tighter credit spreads which offset weak Gross Domestic Product and rising unemployment.

A professionally managed portfolio provides advantages in an uncertain economic environment. No matter the news headlines or market conditions, a professionally managed portfolio comes with one major benefit: diversification. With a diverse portfolio, you have access to several different asset classes, which lessens your risk if one sector suffers heavy losses. Portfolio managers have the flexibility and knowledge to adjust allocations when market conditions change. If you have questions about your investments, a Co-operators financial representative is always ready to help.

Interested in more tips and insights? Check out our Market View page for investment basics and weekly updates on market performance. You can even sign up to have this news sent directly to your inbox.

Sales charges, expenses and other fees

Fees and expenses reduce the return on your investment. For details, please refer to your Policy and Information Folder.

Current rates of return are available on our Segregated Fund Performance page. Your personal rate of return will vary, depending on the contributions and withdrawals you make over time. For details, please refer to your Policy Statement.

If you have questions about your investments, contact your Co-operators financial representative.

Versatile Portfolios NavigatorTM is a flexible and secure investment option

Whether you’re saving for the unexpected, for retirement or for that big item on your bucket list, your path to financial success is unique. Versatile Portfolios NavigatorTM can provide you with the flexibility you need. In addition to select and diverse investment options from top, trusted investment managers, they offer a suite of portfolio funds – all actively managed and consisting of underlying funds – that help you take the guesswork out of investing.

© 2025 Co-operators Life Insurance Company.

1900 Albert St., Regina, SK S4P 4K8

Segregated funds and annuities are administered by Co-operators Life Insurance Company. Not all products are available in all provinces. This material is provided for informational purposes only. Please refer to your policy for applicable coverage details, limitations, and exclusions. The information contained in this communication was obtained from sources believed to be reliable; however, we cannot guarantee that it is accurate or complete. This communication is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell any investment. Co-operators® is a registered trademark of The Co-operators Group Limited and is used with permission. Versatile Portfolios Navigator™ is an investment product which may include features or options such as segregated funds, portfolios of segregated funds or guaranteed rates. Guaranteed benefits are payable on death or maturity (reduced proportionately by withdrawals from, or investment transfers out of, the segregated funds). No guarantee is provided on surrender or cancellation. Subject to any applicable death and maturity guarantee, any part of the premium or other amount that is allocated to a segregated fund is invested at the risk of the policyholder and may increase or decrease in value. Ask your advisor for details. Versatile Portfolios Navigator™ is a trademark of Co-operators Life Insurance Company. True North® is a registered trademark of Fidelity Investments Canada ULC and used with permission.

Returns, investment segmentation and top holdings as of September 30, 2025. Rates of return for periods less than one year are simple rates of return. All others are annualized rates of return. Securities regulations do not allow us to report performance for a fund that has been available for less than one year. The returns reflect changes in unit value and assume that all income/realized net gains are retained by the segregated fund in the periods indicated and are reflected in higher unit values of the fund. The returns do not take into account sales, redemption, distribution or other optional charges or income taxes payable that would have reduced returns or performance. Past performance of any fund is not necessarily indicative of its future performance.

If you have questions or want to discuss your investments, please contact your authorized financial representative. In Quebec, a licensed insurance advisor is a Financial Security Advisor or a Representative.

The Dow Jones Industrial Average and S&P 500 ("Indices") are products of S&P Dow Jones Indices LLC, its affiliates and/or their licensors and has been licensed for use by Co-operators Financial Services Limited Copyright © 2025 S&P Dow Jones Indices LLC, its affiliates and/or their licensors. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC. For more information on any of S&P Dow Jones Indices LLC’s indices please visit www.spdji.com. S&P® is a registered trademark of Standard & Poor’s Financial Services LLC and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC. Neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors make any representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector that it purports to represent and neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors shall have any liability for any errors, omissions, or interruptions of any index or the data included therein.

The S&P/TSX Composite is a product of TSX Inc., its affiliates and/or their licensors and has been licensed for use by Co-operators Financial Services Limited. Neither TSX Inc., their affiliates, nor their third-party licensors make any representation or warranty, express or implied, as to the accuracy of market representation of any index, or the context from which they are drawn, and shall not be liable for any errors, omissions or interruptions of any index or the data included therein.