Quarterly Portfolio Fund update

Read our weekly market recap for the latest information on the financial markets, insights around current headlines, special reports, and more.

How Portfolio Funds performed during Q4 2025

Portfolio funds provided mixed returns in the fourth quarter, with growth and balanced portfolios outpacing income.

Note: Rates of return for each portfolio are provided below on an after-fees (net) basis. Given that fees are only applied at the portfolio level, all references to underlying fund performance are before fees (gross).

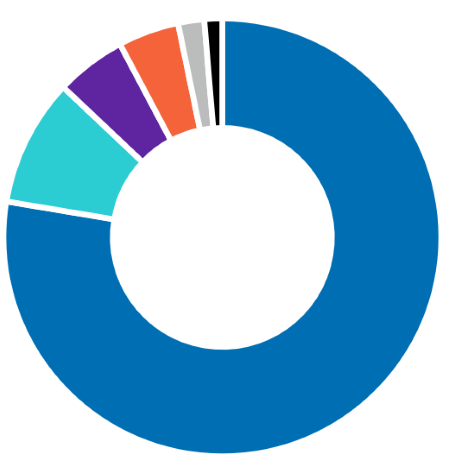

Co-operators Income Portfolio: low risk

Designed to achieve interest income, and the preservation and moderate growth of capital, with low levels of volatility.

Underperformance in the portfolio’s Canadian equity segment, due in large part to an underexposure to gold which rose to record levels during the quarter, was a drag on returns in Q4. The Co-operators Fidelity Canadian Bond Fund helped limit losses by outperforming its benchmark due to its overweight allocation toward Canadian corporate bonds as credit spreads tightened in the quarter.

- Canadian Fixed Income 78.10%

- Canadian Equity 9.81%

- U.S. Equity 4.90%

- International Equity 4.76%

- Cash & Other Net Assets 1.33%

- Foreign Fixed Income 1.10%

| Guarantee level | Q4 | 1 year | 3 year | 5 year | 10 year | Since inception Dec. 22, 2014 |

|---|---|---|---|---|---|---|

| 75-75 | -0.36% | 3.79% | 5.30% | 0.29% | 1.83% | 1.89% |

| 75-100 | -0.39% | 3.68% | 5.18% | 0.19% | 1.72% | 1.78% |

| 100-100 | -0.49% | 3.28% | 4.78% | -0.19% | 1.33% | 1.39% |

| Top 10 holdings | |

|---|---|

| Co-operators Canadian Fixed Income Fund | 30.01% |

| Co-operators BlackRock Canada Universe Bond Index Fund | 30.01% |

| Co-operators Fidelity Canadian Bond Fund | 20.00% |

| Co-operators Mawer International Equity Fund | 5.02% |

| Co-operators Mawer Canadian Equity Fund | 4.99% |

| Co-operators Canadian Equity Fund | 4.99% |

| Co-operators BlackRock U.S. Equity Index Fund | 2.49% |

| Co-operators U.S. Equity Fund | 2.49% |

| The top 10 investments make up 100.00% of the fund. Total number of investments: 8 |

|

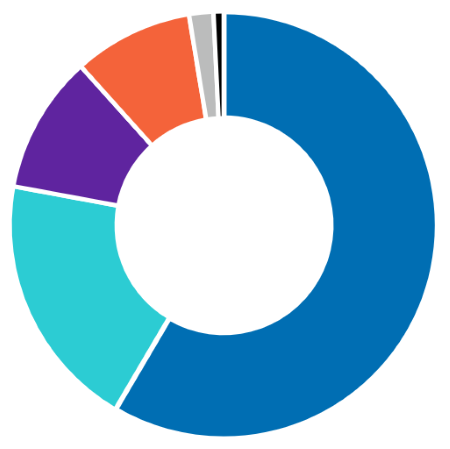

Co-operators Balanced Income Portfolio: low to moderate risk

Designed to achieve both interest income and capital growth, with relatively low levels of volatility.

Underexposure to the Materials and Financials sectors in the portfolio’s Canadian equity segment contributed to the negative return in Q4. The Co-operators Fidelity Canadian Bond Fund helped limit losses by outperforming its benchmark due to its overweight allocation toward Canadian corporate bonds as credit spreads tightened in the quarter.

- Canadian Fixed Income 58.84%

- Canadian Equity 19.61%

- U.S. Equity 9.81%

- International Equity 9.52%

- Cash & Other Net Assets 1.57%

- Foreign Fixed Income 0.65%

| Guarantee level | Q4 | 1 year | 3 year | 5 year | 10 year | Since inception Dec. 22, 2014 |

|---|---|---|---|---|---|---|

| 75-75 | -0.02% | 6.60% | 7.72% | 2.64% | 3.44% | 3.47% |

| 75-100 | -0.06% | 6.42% | 7.54% | 2.47% | 3.28% | 3.30% |

| 100-100 | -0.21% | 5.79% | 6.91% | 1.86% | 2.67% | 2.69% |

| Top 10 holdings | |

|---|---|

| Co-operators Canadian Fixed Income Fund | 25.02% |

| Co-operators BlackRock Canada Universe Bond Index Fund | 25.02% |

| Co-operators Mawer International Equity Fund | 10.04% |

| Co-operators Fidelity Canadian Bond Fund | 10.00% |

| Co-operators Mawer Canadian Equity Fund | 9.98% |

| Co-operators Canadian Equity Fund | 9.97% |

| Co-operators BlackRock U.S. Equity Index Fund | 4.99% |

| Co-operators U.S. Equity Fund | 4.98% |

| The top 10 investments make up 100.00% of the fund. Total number of investments: 8 |

|

Co-operators Balanced Growth Portfolio: low to moderate risk

Designed to achieve both interest income and capital growth, with relatively modest levels of volatility.

Exposure to tech, telecommunications and utilities stocks in the Canadian equity segment benefited the portfolio’s overall positive return.

- Canadian Fixed Income 39.57%

- Canadian Equity 33.64%

- International Equity 14.46%

- U.S. Equity 10.37%

- Cash & Other Net Assets 1.75%

- Foreign Fixed Income 0.21%

| Guarantee level | Q4 | 1 year | 3 year | 5 year | 10 year | Since inception Dec. 22, 2014 |

|---|---|---|---|---|---|---|

| 75-75 | 0.62% | 10.55% | 10.26% | 5.20% | 5.12% | 5.03% |

| 75-100 | 0.58% | 10.37% | 10.08% | 5.03% | 4.95% | 4.85% |

| 100-100 | 0.43% | 9.71% | 9.43% | 4.41% | 4.33% | 4.24% |

| Top 10 holdings | |

|---|---|

| Co-operators Canadian Fixed Income Fund | 20.02% |

| Co-operators BlackRock Canada Universe Bond Index Fund | 20.02% |

| Co-operators Mawer International Equity Fund | 15.06% |

| Co-operators Canadian Equity Fund | 14.96% |

| Co-operators Fidelity True North® Fund | 9.99% |

| Co-operators Mawer Canadian Equity Fund | 9.98% |

| Co-operators BlackRock U.S. Equity Index Fund | 4.99% |

| Co-operators U.S. Equity Fund | 4.98% |

| The top 10 investments make up 100.00% of the fund. Total number of investments: 8 |

|

Co-operators Growth Portfolio: low to moderate risk

Designed to achieve long-term capital growth, with some interest income.

The Co-operators Fidelity Global Fund was the best performing fund within the portfolio and key contributor to the overall positive return in Q4, outpacing its benchmark by 23 basis points. This was primarily due to the fund’s investments within the consumer staples and information technology sectors.

- Canadian Equity 43.79%

- International Equity 21.25%

- Canadian Fixed Income 19.79%

- U.S. Equity 13.09%

- Cash & Other Net Assets 1.98%

- Foreign Fixed Income 0.10%

| Guarantee level | Q4 | 1 year | 3 year | 5 year | 10 year | Since inception Dec. 22, 2014 |

|---|---|---|---|---|---|---|

| 75-75 | 1.23% | 15.07% | 13.03% | 7.71% | 6.83% | 6.71% |

| 75-100 | 1.18% | 14.88% | 12.84% | 7.53% | 6.65% | 6.54% |

| 100-100 | 1.03% | 14.21% | 12.18% | 6.90% | 6.02% | 5.91% |

| Top 10 holdings | |

|---|---|

| Co-operators Canadian Equity Fund | 19.96% |

| Co-operators Mawer International Equity Fund | 15.07% |

| Co-operators Mawer Canadian Equity Fund | 14.98% |

| Co-operators Canadian Fixed Income Fund | 10.01% |

| Co-operators Fidelity Global Fund | 10.01% |

| Co-operators BlackRock Canada Universe Bond Index Fund | 10.01% |

| Co-operators Fidelity True North® Fund | 9.99% |

| Co-operators BlackRock U.S. Equity Index Fund | 4.99% |

| Co-operators U.S. Equity Fund | 4.98% |

| The top 10 investments make up 100.00% of the fund. Total number of investments: 9 |

|

Co-operators Maximum Growth Portfolio: moderate risk

Designed to achieve maximum capital growth over the long term.

Tech-related exposures with the portfolio were positive contributors and helped offset some negative returns within the international equity segment which dampened the portfolio's overall positive return in Q4.

- Canadian Equity 58.34%

- International Equity 21.34%

- U.S. Equity 18.28%

- Cash & Other Net Assets 2.02%

- Canadian Fixed Income 0.02%

| Guarantee level | Q4 | 1 year | 3 year | 5 year | 10 year | Since inception Dec. 22, 2014 |

|---|---|---|---|---|---|---|

| 75-75 | 2.13% | 19.31% | 16.08% | 10.74% | 8.81% | 8.45% |

| 75-100 | 2.07% | 19.06% | 15.83% | 10.50% | 8.58% | 8.21% |

| 100-100 | 1.88% | 18.16% | 14.96% | 9.67% | 7.76% | 7.40% |

| Top 10 holdings | |

|---|---|

| Co-operators Canadian Equity Fund | 19.97% |

| Co-operators Mawer International Equity Fund | 15.07% |

| Co-operators Fidelity True North® Fund | 15.00% |

| Co-operators Mawer Canadian Equity Fund | 14.99% |

| Co-operators Fidelity Global Fund | 10.02% |

| Co-operators BlackRock Canadian Equity Index Fund | 9.99% |

| Co-operators BlackRock U.S. Equity Index Fund | 7.48% |

| Co-operators U.S. Equity Fund | 7.48% |

| The top 10 investments make up 100.00% of the fund. Total number of investments: 8 |

|

Key take-aways

Equity markets performed well in the fourth quarter. The materials sector drove performance on Canada’s benchmark TSX once again, supported by outsized returns from gold and other precious-metal-related companies. Gold capped off an incredible year, rising nearly 60% in 2025. On Wall Street, the positive quarter capped off a third consecutive year of double-digit returns for the major stock indexes. However, U.S. equity markets lagged global peers, in part due to a weakening U.S. dollar. International equities benefitted as investors rotated away from U.S. mega-cap stocks amid concerns over elevated valuations.

In fixed income, Canadian bonds posted slightly negative returns in Q4. The Bank of Canada cut its policy interest rate by 25 basis points in October, citing the potential for global trade disruptions to lower demand for Canadian goods. Despite the central bank’s cautious outlook, economic expectations have since improved. Higher growth, continued government spending and tariff uncertainty have added some term premium to the long end of the Canadian yield curve. In the U.S., a softening labour market increased expectations for rate cuts from the Federal Reserve, which delivered two 25-basis-point rate reductions in the quarter. Continued pressure on the central bank to lower interest rates has contributed to ongoing uncertainty in bond markets, particularly as concerns over central bank independence persist.

Bottom line: Many factors influence the market. The best defence against market uncertainty is having – and sticking to – an investment strategy that’s geared toward your individual goals and objectives. If you have questions or decide it’s time to review your plan, your Co-operators financial representative is here to help.

Interested in more tips and insights? Check out our Market View page for investment basics and weekly updates on market performance. You can even sign up to have this news sent directly to your inbox.

Sales charges, expenses and other fees

Fees and expenses reduce the return on your investment. For details, please refer to your Policy and Information Folder.

Current rates of return are available on our Segregated Fund Performance page. Your personal rate of return will vary, depending on the contributions and withdrawals you make over time. For details, please refer to your Policy Statement.

If you have questions about your investments, contact your Co-operators financial representative.

Versatile Portfolios NavigatorTM is a flexible and secure investment option

Whether you’re saving for the unexpected, for retirement or for that big item on your bucket list, your path to financial success is unique. Versatile Portfolios NavigatorTM can provide you with the flexibility you need. In addition to select and diverse investment options from top, trusted investment managers, they offer a suite of portfolio funds – all actively managed and consisting of underlying funds – that help you take the guesswork out of investing.

© Co-operators Life Insurance Company.

1900 Albert St., Regina, SK S4P 4K8

Segregated funds and annuities are administered by Co-operators Life Insurance Company. Not all products are available in all provinces. This material is provided for informational purposes only. Please refer to your policy for applicable coverage details, limitations, and exclusions. The information contained in this communication was obtained from sources believed to be reliable; however, we cannot guarantee that it is accurate or complete. This communication is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell any investment. Co-operators® is a registered trademark of The Co-operators Group Limited and is used with permission. Versatile Portfolios Navigator™ is an investment product which may include features or options such as segregated funds, portfolios of segregated funds or guaranteed rates. Guaranteed benefits are payable on death or maturity (reduced proportionately by withdrawals from, or investment transfers out of, the segregated funds). No guarantee is provided on surrender or cancellation. Subject to any applicable death and maturity guarantee, any part of the premium or other amount that is allocated to a segregated fund is invested at the risk of the policyholder and may increase or decrease in value. Ask your advisor for details. Versatile Portfolios Navigator™ is a trademark of Co-operators Life Insurance Company. True North® is a registered trademark of Fidelity Investments Canada ULC and used with permission.

Returns, investment segmentation and top holdings as of December 31, 2025. Rates of return for periods less than one year are simple rates of return. All others are annualized rates of return. Securities regulations do not allow us to report performance for a fund that has been available for less than one year. The returns reflect changes in unit value and assume that all income/realized net gains are retained by the segregated fund in the periods indicated and are reflected in higher unit values of the fund. The returns do not take into account sales, redemption, distribution or other optional charges or income taxes payable that would have reduced returns or performance. Past performance of any fund is not necessarily indicative of its future performance.

If you have questions or want to discuss your investments, please contact your authorized financial representative. In Quebec, a licensed insurance advisor is a Financial Security Advisor or a Representative.